geothermal tax credit extension

In December 2020 the tax credit for geothermal heat pump installations was extended through 2023. The tax credit currently stands at 26 percent throughout 2021 and 2022 before decreasing to 22 percent in 2023.

Solar Investment Tax Credit Itc At 26 Extended For Two Years Creative Energies Solar Solar Design Residential Solar Passive Solar Design

This would mean a 30 tax credit through 2024 a 26 tax credit in 2025 and a 22 tax credit in 2026.

. Geothermal equipment that uses the stored solar energy from the ground for heating and cooling and that meets ENERGY STAR requirements at the time of installation is. Because they use the earths natural heat they are among the most efficient and comfortable heating and cooling technologies. Extension for commercial and residential geothermal heat pump GHP tax credits.

As long as your system is up and running by the end of 2022 you can claim. The Energy Efficiency Property Tax Credit residential credit for GHPs is extended for two years at its current level of 26 of total installation cost. The bill extends the 30 percent tax credit for residential and commercial geothermal heat pumps until it begins a phase out in 2020.

What does the Geothermal tax credit extension mean for you. Understanding the Geothermal Tax Credit Extension. Federal Tax Credit The recently signed Federal Budget and Stimulus bill includes an extension of the Federal geothermal heat pump GHP tax credits through 2023.

This Tax credit was available through the end of 2016. Congress extended the applicability of the 26 credit for two years until January 1 2023 and the applicability of the 22 credit for another year until January 1. A 30 tax credit for the installation of a ground source heat pump geothermal system with no cap was enacted in 2009.

Now geothermal tax credits will stay at 26 for 2021 and 2022 before falling to 22 in 2023. The extension was part of the federal governments 900 million COVID relief package passed by Congress in December 2020. New geothermal heat pumps and combined heat and power projects will qualify for a 10 investment tax credit if construction starts by the end of 2023.

Congress authorized a 30 investment tax credit to be claimed on new power plants of up to 50 megawatts in size that generate electricity using waste heat from buildings and other equipment. Christmas came early for the geothermal industry when the latest federal stimulus bill included a long-sought extension of tax credits for geothermal installation. This credit is meant to incentivize home and business owners to install geothermal heat pump based climate control systems instead of more traditional oil electric or natural gas systems.

The 26 federal tax credit was extended through 2022 and will drop to 22 in 2023 before expiring altogether so act now for the most savings. As we mentioned before the geothermal tax credit goes through cycles of reinstatement expiration and renewal within the US. Congress recently approved an extension of federal tax credits for both residential and commercial installations of Geothermal Heat Pumps.

For this reason you should consider helping this pass through. Taxpayers could get a tax credit equal to 25 on geothermal energy system expenditures up to 5000 according to a budget bill introduced by the Assembly. Residential credits are 26 through 2022 then decrease to 22.

Existing tax credits were set at 26 throughout 2020 22 throughout 2021 and falling to zero at the end of 2021. A 26 percent federal tax credit for geothermal installations was extended for two more years. In December 2020 the tax credit for geothermal heat pump installations was extended through 2023.

Homeowners who install geothermal can get the tax credit simply by filling out a form declaring the amount you spent when you file your federal income taxes. In 2019 the tax credit was renewed at 30 of the total system cost which dropped to 26 in 2020. The Energy Efficiency Property Tax Credit residential credit for GHPs is extended for two years at its current level of 26 of total installation cost.

Geothermal heat pumps are similar to ordinary heat pumps but use the ground instead of outside air to provide heating air conditioning and in most cases hot water. In July a bill was introduced to the House and Senate to push for a five-year extension of the 30 tax credit for Geothermal systems. Federal Tax Credit The recently signed Federal Budget and Stimulus bill includes an extension of the Federal geothermal heat pump GHP tax credits through 2023.

This number will carry through until the end of 2022 and drops to 22 in 2023. Property is usually considered to be placed in service when installation is complete and equipment is ready for use. Congress on Monday passed a massive spending bill that includes 35 billion in energy research and development programs a two-year extension of the Investment Tax Credit for solar power.

In 2023 and expire January 1 2024. In 2023 the credit steps down to 22 and then expires on Jan. The credit is retroactive for any installation placed in service after the original Dec.

The extension is good news for those considering the benefits of geothermal. It will save you money upgrading your geothermal system or upgrading to. It is a full extension which parallels the treatment of the wind and solar tax credits.

The new legislation lengthens the deadline for the credits for GHP installations. In 2023 the credit steps down. Commercial credits will remain at 10 through 2023.

It keeps the tax credit at 26 percent for residential geothermal for 2021 and 2022.

Geothermal Energy For Sustainable Heating And Cooling Temperate Climate Permaculture Geothermal Energy Geothermal Geothermal Heating

Here S How To Take Advantage Of The Solar Tax Credit Extension In 2021 In 2021 Solar Solar Panel Repair Tax Credits

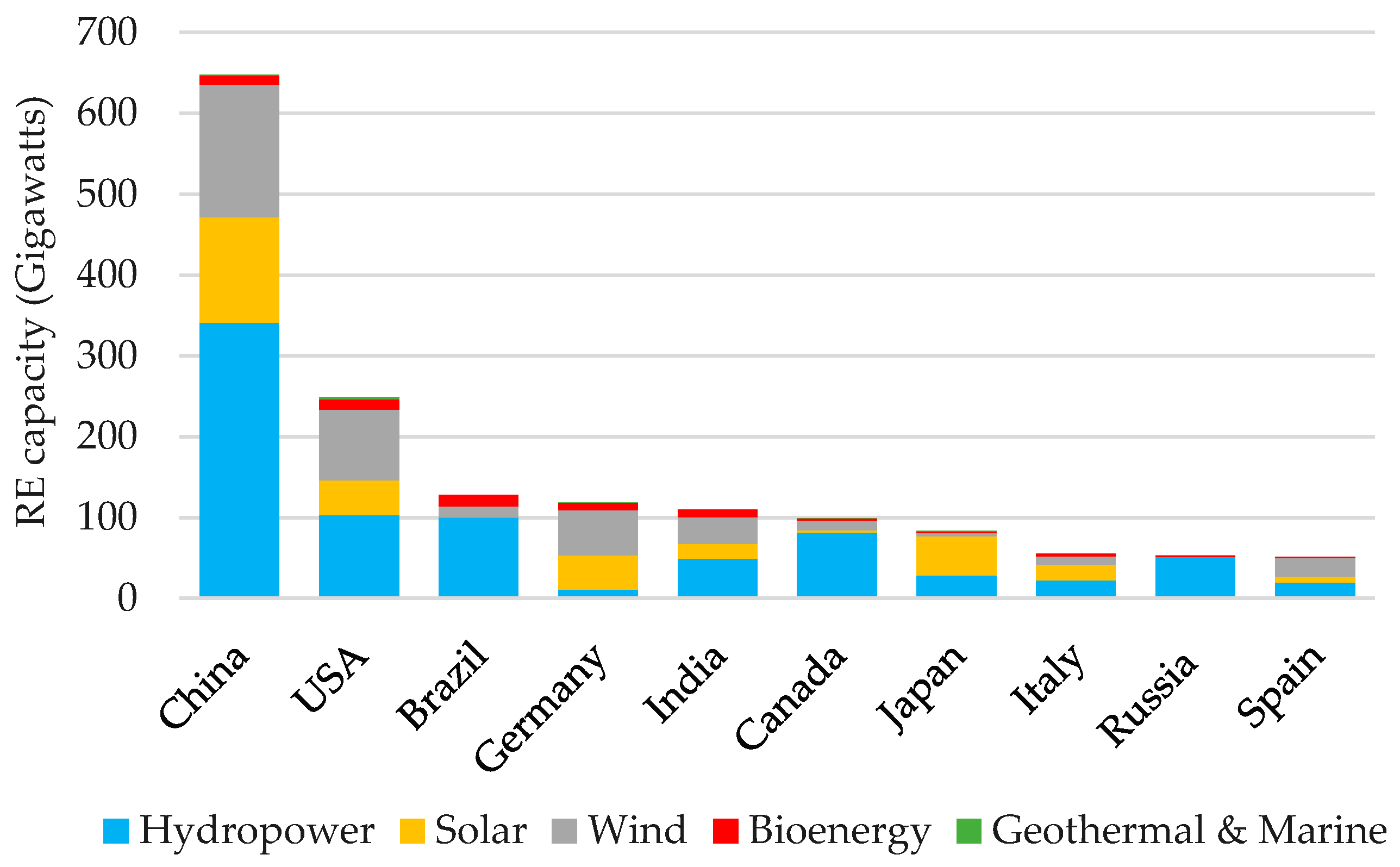

Sustainability Free Full Text Development Of Renewable Energy In China Usa And Brazil A Comparative Study On Renewable Energy Policies Html

Factors Affecting The Cost Of Geothermal Power Development

Cost Of Solar Energy Dropped 30 In Year Trump S Coal Visit Solarpowercee Com For The Latest Solar Products Solarene Solar Energy Solar Solar Energy System

Geothermal Investment Tax Credit Extended Through 2023

How The Itc Extension Ensures Future Growth Of Solar For Homeowners And Businesses Solar Solar Energy Growth

Art Print Prather S Fire Ice Design 24x16in Geothermal Energy Geothermal Energy Crisis

2013 Wind Turbine Federal Tax Credit Passed Wind Turbine Wind Power Wind Energy

Reducing Risk Easier Permitting And Tax Parity Crucial For Geothermal In U S Thinkgeoenergy Geothermal Energy News

Geothermal Heat Pump Tax Credits Approved By Congress Geothermal Heating And Cooling Chesapeake Geosystems

Geothermal Investment Tax Credit Extended Through 2023

What Is The 2021 Geothermal Tax Credit Climatemaster Geothermal Hvac

What Is The 2021 Geothermal Tax Credit Climatemaster Geothermal Hvac